|

| ||||||||

The tax code selected during tax calculation on the Invoice Reconciliation (IR) is not the tax code that is expected.

As long as your user has one of the following roles: Customer Administrator, Tax Manager

- Click Manage > Core Administration > Data Import/Export > Export

- Search for "tax code"

- Click Export for either Export Tax Code Lookup or Export Tax Code Lookups v2, whichever you maintain

Next, once you have downloaded the file to your computer and located it:

- Open the file using Microsoft Excel or equivalent .csv file editor that allows for column filtering

- If using Microsoft Excel expand all columns by pressing CTRL+A and then pressing ALT+H+O+I

- Select the column headers and click Sort & Filter > Filter

Once the file is ready to be filtered, navigate back to the IR and open the tax details.

- If this is for line level tax select the line item and click View Tax Details

- If this is for header level tax, the values under Header Information apply

Note the selected tax code, and consider the tax code you expected to be generated.

Now in back in Microsoft Excel start to filter each column based on the data for the line item / header where the tax code for the tax was generated.

NOTE: The key step is to select the values that match the data on the document but also ensure to include blank values while filtering the file. Blank values are treated as wildcards and carry the same weight as exact matches.

Using this method we should be able to determine why the tax code that was generated is in-fact expected based on the tax code lookup configuration.

Most commonly, there is two or more lookups that have all of the same lookups except one record has a null value for one of the look ups and both lookups have the same rank.

In this case it will be ambiguous by the system for which record and tax code gets picked. Further specificity would need to be added or the ranking would need to be changed.

Example:

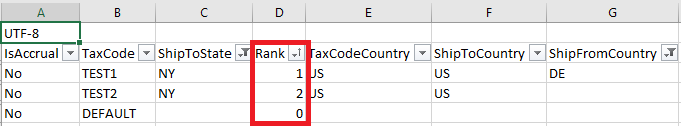

Also common is when there is a lookup using all wildcards that has a lower rank (0 being the lowest rank/highest priority) than the lookups using the more specific lookup values.

The lower ranking default tax code lookup matched the lookup criteria therefor will be selected in this scenario. Wildcard or default tax code lookups should always have the highest (lowest priority) rank.

Example:

If the View Tax Details button is not visible on the IR Line View tab the feature Enhanced Invoice Reconciliation Tax View is not enabled in your site.

Instead you can check the line item details for the shipping / delivery address data.

Invoicing

Invoicing > Invoice Reconciliation > Invoice Reconciliation Tax Tables